Amid national debates about income inequality and tax cuts for the ultra-rich, one talking point is frequently highlighted in online memes and by political figures such as Bernie Sanders is that online retailing giant Amazon.com, despite taking in $5.6 billion in profit in 2017, paid no federal corporate income taxes for that year:

(With respect to the claim about Amazon employees on welfare, see our fact check on that topic here.)

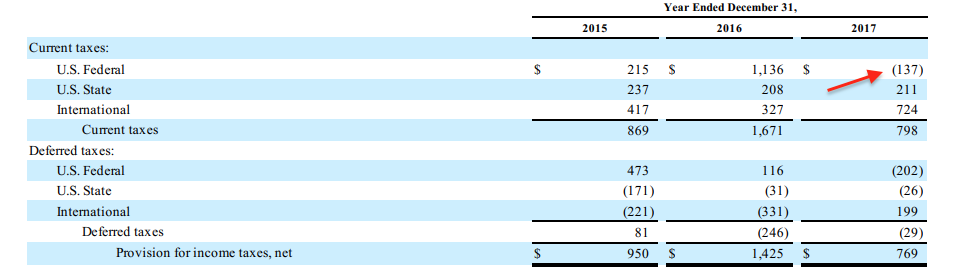

In regards to U.S. federal income taxes, the claim that Amazon paid none in 2017 is almost certainly factual. While Amazon’s tax filings are not public, their SEC filing for the year 2017 illustrates that the company used the tax code expertly (and legally) to their advantage, so well that the company anticipated a $137 million tax refund from the federal government (numbers are in millions of dollars):

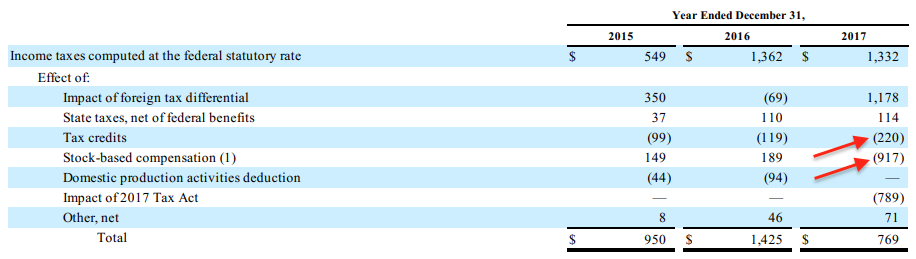

Amazon did pay taxes to individual U.S. states ($211 million) and to international jurisdictions ($724 million), but their federal income tax burden was (less than) zero. The filings indicate that two factors provided the lion share of Amazon’s reduced federal tax liability: $220 million worth of tax credits, and $917 million in tax-deductible executive pay derived from the sale of stocks:

The third negative item in the SEC filing, $789 million in reduced tax burden as a result of the 2017 Tax Act, will be applied to future tax years, according to a report from the Institute on Taxation and Economic Policy.

$220 Million in Tax Credits

SEC filings do not require a company to list the specific credits they utilize, but there are several avenues Amazon would likely have pursued. Annette Nellen, a professor and director of the Master of Science in Taxation program at San Jose University, said that Amazon’s write-offs likely include credits for research and development, domestic production, and equipment depreciation. And according to a report from the Economic Policy Institute, Amazon receives myriad tax incentives from state and local governments as well:

The expansion of Amazon’s physical distribution network has coincided with a strategic business plan of negotiating millions in tax abatements, credits, exemptions, and infrastructure assistance from state and local governments in the name of regional economic development. By the end of 2016, Amazon had likely received over $1 billion in state and local subsidies for its facilities, which would include not only fulfillment centers but “sortation” centers that only sort packages, mailing centers, and other facilities.

$917 Million in Stock-Based Compensation

Publicly-traded corporations can list the stock options they grant to employees as a business cost in their accounting, and if an option-receiving employee makes over $1 million a year in salary, the profits from the sale of those stocks can be then counted as a federal income tax deduction for the corporation (primarily due to a Clinton-era compromise over how to cap executive pay). Stock options allow an employee to purchase stock in their employer’s company at a set price, regardless of its current market value:

Options give executives and investors the right to buy shares of a company at a later date and at specific prices. For example, if a chief executive joins a media company when its stock is trading at $55 a share, but years later, the share price has skyrocketed to $100, that chief executive can still buy the shares at $55, pocketing the massive difference.

In the cases of their highest paid employees, Amazon and other companies are able to deduct the “massive difference” employees make when they sell that stock at a profit. According to the Center for Tax Justice, “because companies typically low-ball the estimated values, they usually end up with much bigger tax write-offs than the amounts they deduct as a 'cost' in computing the profits they report to shareholders.” The $917 million in stock-based compensation listed in Amazon's SEC filing likely stems from their top employees' cashing in on their stock options for a large profit.

While it is impossible to know the exact amount of money Amazon did or did not pay to the federal government in 2017, their own accounting suggests that they expected their federal corporate income tax burden to be negative that year.