A June 8, 2021, investigative report by the nonprofit news outlet ProPublica revealed what many probably already knew but couldn't quantify in detail: The nation's wealthiest people pay negligible taxes, leaving modest wage earners footing the heftiest tax bills.

The report was based on 15 years of records obtained by ProPublica detailing taxes paid by the likes of Elon Musk, Jeff Bezos, Mark Zuckerberg, Warren Buffet, Carl Icahn, and more.

For example, Tesla founder Musk, who is the second richest person in the world, paid no federal income taxes in 2018, according to ProPublica. The same went for Amazon founder Bezos in 2007. Bezos is the world's richest person.

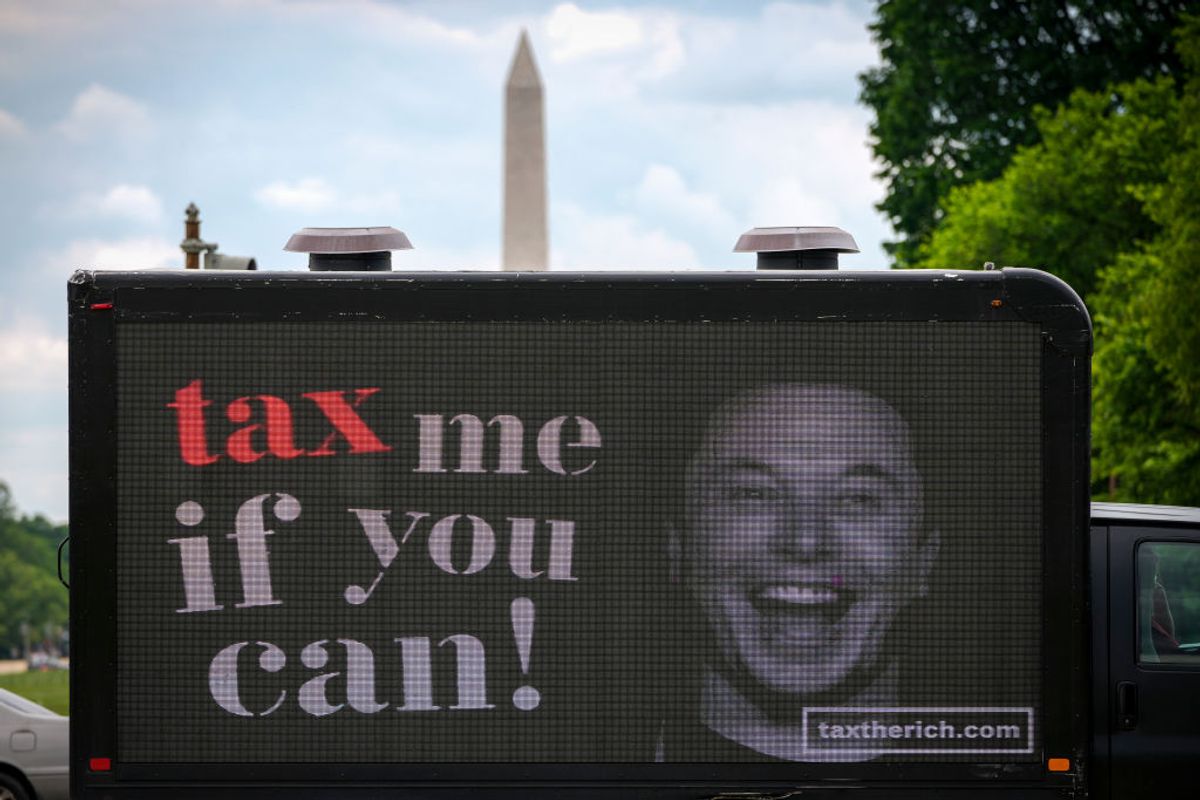

"Taken together, it demolishes the cornerstone myth of the American tax system: that everyone pays their fair share and the richest Americans pay the most," ProPublica reported. "The IRS records show that the wealthiest can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year."

In sum, ProPublica reports that the wealthiest people avoid paying taxes using legal means that the average American doesn't have access to. Because the government taxes income, those living on an income pay the most tax. But if you are a billionaire stashing your wealth in assets not defined as taxable income (like stocks), the majority of your wealth stream isn't subject to income tax.

For context, ProPublica compared the rise in wealth each year for the 25 richest Americans and their taxes paid:

"The results are stark. According to Forbes, those 25 people saw their worth rise a collective $401 billion from 2014 to 2018. They paid a total of $13.6 billion in federal income taxes in those five years, the IRS data shows. That’s a staggering sum, but it amounts to a true tax rate of only 3.4%."

By comparison, typical American wage earners in their 40s saw a wealth increase of about $65,000 between 2014 and 2018, but footed tax bills totaling $62,000 over that same period, according to ProPublica.

"Nothing in the report surprised me," said Steven Rosenthal, senior fellow for the Urban-Brookings Tax Policy Center, in a phone interview with Snopes. "Of course the very wealthiest recognize little of their wealth in the form of income every year. In recent years, with the dot com boom and the explosion in the value of intellectual property, there have been some very successful zillionaires. They start businesses of which they remain either the principal or one of the largest owners, and then they don’t sell their stock."

The current tax system doesn't tax stock gains unless the stock is sold, which has been the case for a century, Rosenthal said. Rosenthal called U.S. President Joe Biden's proposal to tax assets at death a modest plan to tax this wealth.

"At a minimum we ought not allow this accumulated wealth to escape any taxation," he stated.

Rosenthal pointed out that although the figures in the ProPublica story reveal a lot about the shortcomings of the current tax code, the onus to fix it is on Congress.

"No one is obliged to pay more taxes than are due," Rosenthal said. "It's incumbent on Congress to change the rules if we don’t like the way the rules are operating. We can’t expect people to interpret rules or apply rules in the way that’s the most favorable to the government."