Part II: Piggy Budget

- Several affiliate marketing agencies ultimately owned by Max Polyakov or his close associates pay third parties to promote effectively fake online merchants that provide little if any actual service.

- These fake companies are used in deceptive "sweepstakes" campaigns that offer the alleged chance to win popular items like iPhones. To enter, a registrant must provide a credit card number.

- The people who enter these "sweepstakes," in reality, are signed up for a recurring monthly subscription to these token merchants. These merchants purport to offer access to e-books, streaming services, or budgeting services.

- These effectively fake merchants all use the same payment services provider to process credit card charges. That company, Maxpay, is majority-owned by Max Polyakov.

"As long as people think good things can happen to them for no reason, we are there to shatter their pink-tinted glasses, show that our world is full of deception and make a quick buck while we’re at it.

A delight, isn’t it?"

— ClickDealer Blog, January 2016

On March 18, 2021, a Reddit user helping with an elderly parent's finances asked for advice regarding the discovery of several charges "that seemed fraudulent" on the parent's Visa debit card. On billing statements, the charges appeared as "MrPiggyBill." After calling the parent's bank and canceling the card, the Reddit user was assured that the money would be refunded. A month later, the bank changed its mind, refusing to issue the refund because the person "had 'signed up for a service' and provided their email and credit-card number."

MrPiggyBill is a billing alias used by a network of nearly identical websites with names like Piggy Budget, Mr Piggy Budget, Miss Piggy Budget, Polar Bear Budget, Budget Bear, My Online Economy, and Expense Friend. The above bank's characterization to the contrary, these websites do not appear to offer anything more than a token "service" for which one could "sign up." Somewhat perversely, the service these companies claim to provide is helping people manage their finances. They profit, however, from people who are unable to do so.

These "Piggy Budgets," as we term them here, exist in a larger ecosystem of token subscription-based services that are commonly the subject of online complaints. The business entities that own the Piggy Budgets, in several cases, also own a massive network of identical or nearly identical e-book subscription services. Some of the purported brands in this category include: Book Lounge, Book Couch, Book Divan, and Ebookwormers. Like the PiggyBudgets, the "Book Lounges" do not appear to offer much in the way of services either.

Generally speaking, the reason most people are unable to recognize the charges appearing on their or their loved one's credit card statements is that the people who signed up for these purported services have never actually interacted with the digital storefronts shown above. These homepages are, in effect, Potemkin shop windows that serve to create the illusion of legitimate business activity.

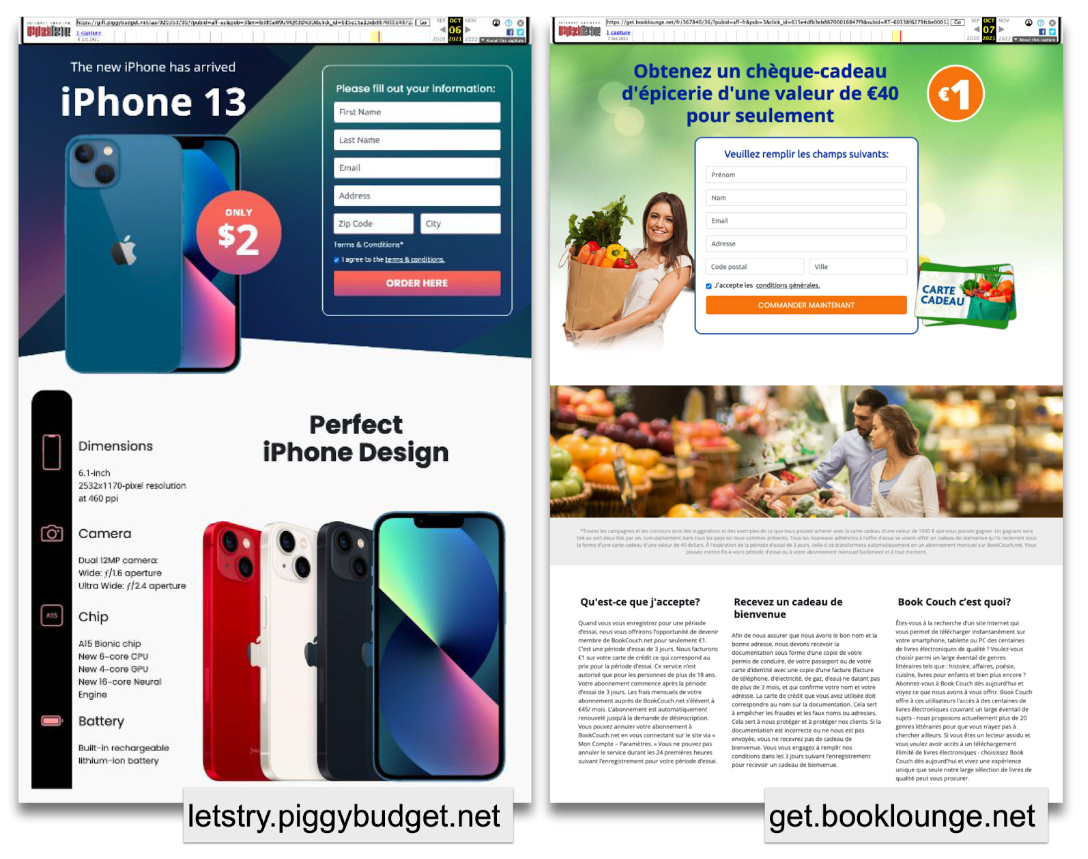

Individuals who end up interacting with these websites usually arrive via a "sweepstakes" contest allegedly used as a marketing campaign for one of these fake services. The pages, which usually present themselves to their victims through banner or pop-up ads, claim to offer a chance to win prizes for the cost of a small entry fee. Here are two examples of how Piggy Budget (left) and Book Lounge (right) would actually appear to someone being targeted by the scam.

Complaints left on various scam-watching forums detail how people get duped. "A message popped up … and then said I'd won a phone, just pay delivery. … Next minute I get 'confirmation' that I had subscribed to Ebookwormers and couldn't unsubscribe and had waived my right to a refund." Another commenter, in a complaint about the same service, also referenced iPhones: "Answer quiz and may win a smartphone," one commenter reported. "Win but pay $2. Enter card details and then they immediately take $77 from [the] card. It's a total scam. They get at least $79 from each fool that believes their crap."

People who enter these contests are usually signed up for a three-day trial. "We charge $2 from your credit card, which is the price of the trial," one landing page stipulates. "After the 3-day trial period, your subscription starts." In another example, the sweepstakes' fine print assures you that "you can terminate your trial period or monthly membership easily and at any time." This is not true, either. Reading further, a prospective contest entrant would learn that "you can not cancel the service during the first 24 hours after the registration of your trial" — a stipulation that increases the chances that someone forgets having put their credit card at risk.

Ultimately, the Piggy Budget company "sponsoring" the contest as well as the alleged prize are afterthoughts. This is made clear in the fine print on the landing pages. The iPhone or whatever other gift is advertised as the prize is not actually what is being (allegedly) raffled. Such items are merely "suggestions and examples of what you can buy with a gift card worth $1000."

In other words, under the guise of an already deceptive sweepstakes giveaway, individuals unwittingly signed up to incur real and recurring charges from apparently bogus companies. While it is hard to determine exactly where the money from these scams goes, one thing is clear: Max Polyakov and his advertising and e-commerce empire play a role in facilitating multiple stages of the operation, at a bare minimum.

CC Submit

In general terms, affiliate marketing is the practice of paying third parties to promote products or services. In 2012, a senior affiliate marketing manager from Polyakov's former dating company, Cupid plc, co-founded ClickDealer. Via several holding companies, Polyakov is the largest individual shareholder in ClickDealer's parent company, GDM Group Limited, at the time of this reporting, and he may financially benefit further via a United Arab Emirates shell company. ClickDealer, in theory, allows Polyakov to profit from the large base of affiliate marketers already engaged in promoting his dating websites for a variety of additional marketing tasks.

ClickDealer and other agencies like it operate on a cost per action (CPA) basis. Depending on the campaign, affiliates can get paid per credit card number received, per email address entered, or through a host of other actions. ClickDealer is far from the only player in this economy, but it's a big one. Paying individuals to drive traffic to dating websites and/or using those websites to collect personal data or email addresses has been central to ClickDealer, but they are not its only hustle.

Another of ClickDealer's mainstays has been sweepstakes-based marketing campaigns. An October 2020 post on ClickDealer's corporate blog detailed the steps one affiliate marketer allegedly took to earn a $10,000 profit from a so-called "CC-submit" sweepstakes offer. In a CC-submit campaign, the affiliate marketer gets paid on a per credit card basis. The particular offer highlighted by ClickDealer paid out $20 for each valid credit card number submitted through the sweepstakes' landing page.

ClickDealer did not respond to Snopes' request for comment.

Plausible Deniability

Tracing the agency of origin of any specific affiliate marketing sweepstakes ad is challenging because of a massive number of competing or colluding agencies that traffic in the same or similar offers. Any given affiliate link often goes through a series of website redirects that log information about the activity of several marketing agencies. Affiliate agencies make deals with other affiliate agencies to promote or re-promote the same offers.

The clearest evidence of specific affiliate marketing campaigns promoting Piggy Budgets or Book Lounges comes from other smaller CPA agencies that appear to be more generous with providing details about their offers in public forums. Any of these smaller agencies can and sometimes do make direct deals with companies that want marketing, but they usually push repackaged offers provided by larger networks. In some cases, the public-facing offers of these agencies make the mistake of explicitly mentioning the bogus merchant in their title, as happened below with Piggy Budget:

![Screenshot of affplus.com advertisement for a Piggybudget iPhone 13 Offer. The description reads "Get a iPhone 13! Apply Today! Conversion Requirements: Offer Converts On Valid CC Submit Offer Cap: 50 Daily Restrictions:[sic]No Re-Brokering[sic]No incent[sic]No Adult[sic]No SMS[sic]No Cashback[sic]No Pops[sic]No Fraudulent traffic[sic]No Misleading Allowed P …"](https://media.snopes.com/2022/09/cpa-affiliates-offer-pb.png)

Nevertheless, it is often unclear even to these agencies where such offers (or the companies pushing them), actually come from. "Whenever possible, we work with and work to establish collaborations with advertisers directly, and currently host a number of direct offers," a representative for the Piggy Budget-promoting affiliate marketing agency CPA Affiliates Network told Snopes via email.

"However," he added, "to offer our affiliates a wider range of category offers, we do also work with a select number of other networks." Piggy Budget was an offer from an outside network that CPA Affiliates Network removed, he said, after our request for comment. "Due to the changeable nature of network hosted offers, we do not have the time or resources to investigate all network offers we host."

In addition to including ClickDealer, this ecosystem has several additional affiliate marketing companies linked at least indirectly to Polyakov and his dating empire. Snopes' 2020 investigation, for example, focused on an affiliate marketing company named TopOffers that was at least on paper run by former employees of the Polyakov dating companies Together Networks or Cupid plc. TopOffers shut down a few months after that investigation was published.

Another marketing agency staffed and allegedly owned by former employees of Together Networks or Cupid plc is AdsEmpire. This company, which also has several former TopOffers employees on its payroll, began operations a month after TopOffers shut down. In addition to promoting dating websites, according to marketing material for both companies, affiliates are able to promote sweepstakes offers through these agencies.

Snopes is unable to tie the Piggy Budget and Book Lounge landing pages described above to specific affiliate marketing campaigns or agencies. We have, however, identified 11 websites purporting to be budgeting or e-book services used in deceptive sweepstakes campaigns. All of them appear to use the services of a Polyakov-controlled payment services provider named Maxpay.

In November 2017, Maxpay and ClickDealer announced that they had entered into a "strategic partnership" that included "cooperating to build a single system to increase business" for their clients. "When Maxpay handles your payment processing," a Maxpay blog post explains, "ClickDealer gets traffic performance metrics from your website for optimization. Using them, ClickDealer can determine the most profitable sources and deliver high-value users to your portal."

From December 2020 to November 2021 — the period of time for which Snopes has detailed data — over 15% of referral traffic to Maxpay's URLs stemmed from those 11 fake e-book or budgeting merchants. Snopes interprets most of the Maxpay referral data as proxies for transactions between online merchants and Maxpay. The methods used by Snopes to reach these conclusions are detailed in this supplemental note.

Book Lounge, the token e-book site used in sweepstakes campaigns, was Maxpay's second most significant source of referral traffic, accounting for over 49,000 referrals. Piggy Budget, for its part, accounted for over 4,000.

'Fraud Shall Not Pass'

A recurring theme found in online complaints from people duped by a Piggy Budget or a Book Lounge is that banks ultimately declined to refund the money taken in these operations. Recall the Redditor whose elderly parent was getting charged by MrPiggyBill was unable to recover the funds because the parent had access to the terms-of-service agreement at the time, and the transaction was therefore legitimate.

These sweepstakes' landing pages come fully prepared with data to fight banks and credit card companies over disputed transactions. That's because Book Lounge, Piggy Budget, and all the other fake merchants whose landing pages are used for the CC submit sweepstakes run an "anti-fraud" service named Covery. Covery, until sometime after April 2022, was a wholly owned subsidiary of Maxpay. It is now a separate, Cyprus-registered company.

In basic terms, Covery uses a variety of means to collect and log data about you, your device, and your online behavior, especially throughout the course of an online purchase. If customers allege that they did not make a transaction, Covery provides precise data on behalf of their clients to the financial institution at issue with data "proving" a matching user was on a payment page and had access to their terms-of-service at the time a transaction was made.

"This way you can prevent risky transactions from becoming chargeback disputes in the future, and if they do," a Covery blog post reads, "you have sufficient details to prove you are right." As used on these sweepstakes pages, the practice is a cynical reframing that places the proprietors of fraud as the victims of the very people they themselves defraud.

Albeit unintentionally, the Covery script running on these sweepstakes pages provides an indisputable link between these predatory scams and Polyakov the space visionary. Where money derived from these campaigns actually ends up, as the final installment of this series will show, is difficult to show. What is apparent, however, is that Polyakov is one of the people who profits substantially from these campaigns, and his company Clickdealer is plausibly involved in their current or past promotion.

In Part III, Snopes describes the fate of the only grift apparently more significant to Maxpay's business than the fake sweepstakes: the Together Networks online dating empire. In the years since our first investigation, Snopes has observed in real time a convoluted set of apparent transactions that allegedly demonstrate Polyakov no longer has an interest in them. This too, Snopes reveals, is deception.