Scam: Accounts of check fraud being perpetrated at Walmart stores by employees and customers.

Example: [Collected via e-mail, July 2007]

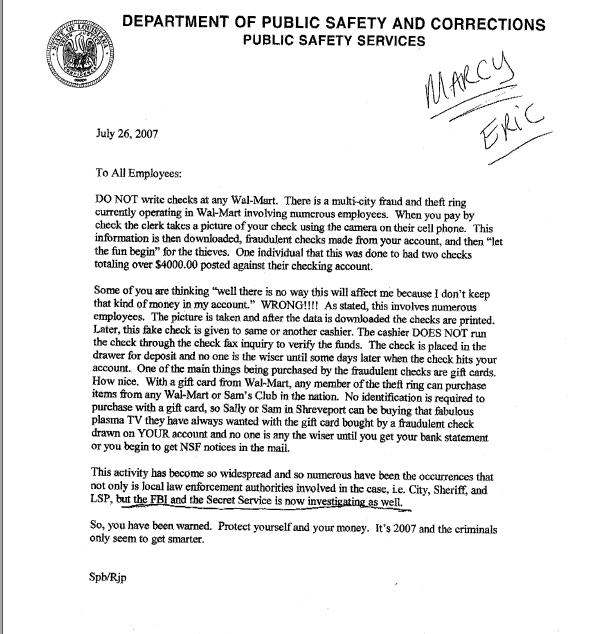

Origins: The image displayed above supposedly reproduces a 26 July 2007 memo (circulated as a

As for the question of whether this memo actually was written by a Louisiana official, we note that the Louisiana State Police (LSP) disclaimed the memo's appropriateness without denying that it originated within the DPSC:

This letter was not official or sanctioned in any way by the Department of Public Safety; unfortunately this letter was made public. The Department will be conducting an internal investigation and, at the conclusion of the investigation, will take the appropriate corrective and/or disciplinary action. Members of the public should not rely on information contained in the letter. As always, consumers are cautioned to take steps to limit disclosure of their personal information and to be aware of their surroundings.

On Thursday, July 26, 2007, an unauthorized letter was distributed to employees in the Baton Rouge field office of the Louisiana Department of Public Safety and Corrections, Office of Motor Vehicles, concerning an alleged multi-city fraud and theft ring operating at Wal-Mart involving Wal-Mart employees. It was alleged in the letter that the employees of the store would obtain a customer's checking account information, and the information would be used to create fraudulent checks.

As for the content of the memo, we note that instances of check fraud have been tied to a then-new practice (used in some

For example, TV station KTRK in Houston reported the following check-theft scam by a

When you write a check at Wal-Mart, you hand it to a clerk who then runs the check through an electronic scanner and hands it back to you. Unfortunately some Pam Davis never thought writing a $37 check at She said, "I had gone to Wal Mart and written a check for $37 and did not realize I did not get that check back, which is the custom with electronic transfer. You are supposed to Davis says — and authorities confirm — a clerk at Five times, they changed the amounts each time," Davis claimed. "It was almost $3,000." Authorities believe the clerk gave the checks to other people who then went on shopping sprees inside the store. Capt. Mark Herman with Precinct 4 said, "In some of the cases they were getting $300 Constables say the clerk did the same thing with checks written by other

A former Wal-Mart employee is behind bars for her role in what authorities are calling a check fraud scheme.

receive the check back."

February 2016 also saw the sentencing of a Walmart customer who (along with his wife) defrauded other customers of hundreds of thousands of dollars through the method of peeking over their shoulders to obtain personal information which the couple used to create counterfeit checks:

Robert MacVittie and his wife lined up behind customers trying to cash payroll checks at "dozens and dozens" of Wal-Mart stores in 20 states and recorded them providing their Social Security numbers, Assistant U.S. Attorney Gregory Melucci said at the hearing where MacVittie received a 34-month sentence. The couple would then use the victims' identities to create counterfeit checks, which they cashed at other Wal-Marts. Melucci called MacVittie, 35, and his wife Jennifer, 32, "the Bonnie and Clyde of counterfeit checks." More than 400 people had their identities used on the successfully cashed counterfeit checks, Melucci said.

A man who cashed $300,000 worth of counterfeit checks using personal information stolen by peeking over the shoulders of hundreds of Wal-Mart customers was sentenced to prison.

Although it is possible a similar type of fraud could be effected by clerks' surreptitiously using cell phones to photograph customer checks, we have not been able to verify that this specific form of theft is occurring, much less that is taking place on a multi-city level by organized rings of

A few tips can be helpful to shoppers to avoid falling victim to this sort of fraud:

- Be aware of how the stores you patronize process checks. If they scan checks to use them as EFT authorizations, be sure your check is returned to you before you leave the checkout counter.

- Use your bank's web site to monitor your checking account transactions online and notify your bank immediately if you spot any suspect transactions.

- Using credit cards (or debit cards) rather than checks generally makes it easier to challenge fraudulent transactions and limit your liability for illegitimate charges.