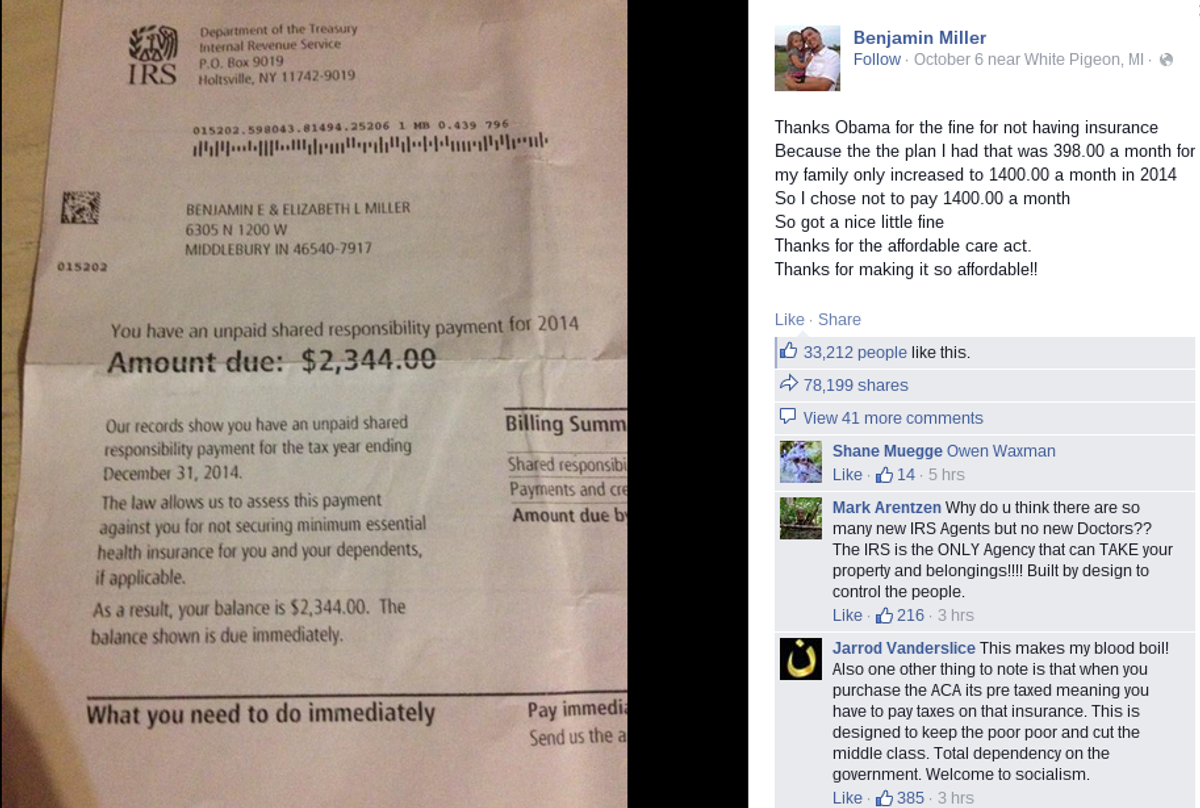

On 6 October 2015, Facebook user Benjamin Miller uploaded an image ostensibly showing a notice he had received from the Internal Revenue Service (IRS) informing him that he owed a $2,344 penalty "not securing minimum essential health insurance," which he posted along with a message "thanking" President Obama for making insurance so affordable:

Thanks Obama for the fine for not having insurance

Because the the plan I had that was 398.00 a month for my family only increased to 1400.00 a month in 2014 So I chose not to pay 1400.00 a month So got a nice little fine

Thanks for the affordable care act.

Thanks for making it so affordable!!

The details of Miller's insurance plan are unknowable without additional information that is protected by privacy laws, but if we take what he wrote at face value, then the Miller family was paying $4,776 per year for health insurance prior to some point in 2014. When that insurance rate increased to $16,800 per year in 2014, Miller decided to stop paying for health insurance, thereby violating the Individual Shared Responsibility Provision of the Affordable Care Act, which requires individuals to provide "minimum essential health insurance coverage" for themselves and their dependents, with failure to do so punishable by the imposition of monetary fines administered by the IRS:

The individual shared responsibility provision requires you and each member of your family to do one of the following:

- Have qualifying health coverage called minimum essential coverage;

- Qualify for a health coverage exemption,

- Make a shared responsibility payment when you file your federal income tax return.

Many people already have minimum essential coverage and do not need to do anything more than maintain that coverage and report their coverage when they file their tax returns.

According to the official HealthCare.gov web site, the penalty for failure to maintain health insurance is determined by one's income and escalates each year:

If you don’t have health insurance in 2016, you’ll pay the higher of these two amounts:

2.5% of your yearly household income (Only the amount of income above the tax filing threshold, about $10,150 for an individual in 2014, is used to calculate the penalty.) The maximum penalty is the national average premium for a Bronze plan.

$695 per person ($347.50 per child under 18) The maximum penalty per family using this method is $2,085.

If you don’t have coverage in 2015, you’ll pay the higher of these two amounts:

2% of your yearly household income. (Only the amount of income above the tax filing threshold, about $10,150 for an individual, is used to calculate the penalty.) The maximum penalty is the national average premium for a Bronze plan.

$325 per person for the year ($162.50 per child under 18). The maximum penalty per family using this method is $975.

If you didn’t have coverage in 2014, you’ll pay the higher of these two amounts:

1% of your yearly household income. (Only the amount of income above the tax filing threshold, about $10,150 for an individual, is used to calculate the penalty.) The maximum penalty is the national average premium for a Bronze plan.

$95 per person for the year ($47.50 per child under 18). The maximum penalty per family using this method is $285.

Since Benjamin Miller's posted IRS notice states he was fined $2,344 for the 2014 tax year, a period in which the penalty was assessed at 1% of yearly household income above the filing threshold, that suggests the Millers' total income was upwards of $244,000 in 2014 — well above the maximum income figure to qualify for health insurance subsidies:

Most of the people who qualify for the subsidies that equal or exceed the cost of some of the lower-priced health insurance plans must have income at or below $28,725 for an individual and $58,875 for a family of four. Most of this money is paid for by taxpayers, including higher-income Americans (those earning $200,000 per year if single and $250,000 for families), and is in the form of higher taxes on investment income and an additional Medicare tax on wages.

Some key elements are missing from this story as well. We don't know from the information provided whether the Millers' health insurance rates increased as a direct result of the Affordable Care Act, or whether they were raised due to unrelated factors (such as the ages of the insured). We also don't know if Miller made any attempt to find comparable insurance (from a different company or through the state Health Insurance Exchange) in the same price range, or whether he just decided that the increase in the cost of his current plan was too high and simply let his insurance lapse without seeking any other alternative.